Renters Insurance in and around Rutland

Welcome, home & apartment renters of Rutland!

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Rutland, VT

- Chittenden, VT

- West Rutland, VT

- Mendon, VT

- Killington, VT

- Brandon, VT

- Fair Haven, VT

- Manchester, VT

- Woodstock, VT

- White River Jct, VT

- Ludlow, VT

- Middlebury, VT

- Rochester, VT

- Springfield, VT

- Brattleboro, VT

- Bennington, VT

- Montpelier, VT

- Barre, VT

- Burlington, VT

- Stowe, VT

- St. Johnsbury, VT

- St. Albans, VT

- Essex, VT

- Lyndonville, VT

Home Is Where Your Heart Is

There's a lot to think about when it comes to renting a home - size, location, furnishings, townhome or condo? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Welcome, home & apartment renters of Rutland!

Your belongings say p-lease and thank you to renters insurance

Open The Door To Renters Insurance With State Farm

When the unpredicted abrupt water damage happens to your rented apartment or space, generally it affects your personal belongings, such as an entertainment system, a set of golf clubs or a tool set. That's where your renters insurance comes in. State Farm agent Ernest Soto is dedicated to help you evaluate your risks so that you can protect your belongings.

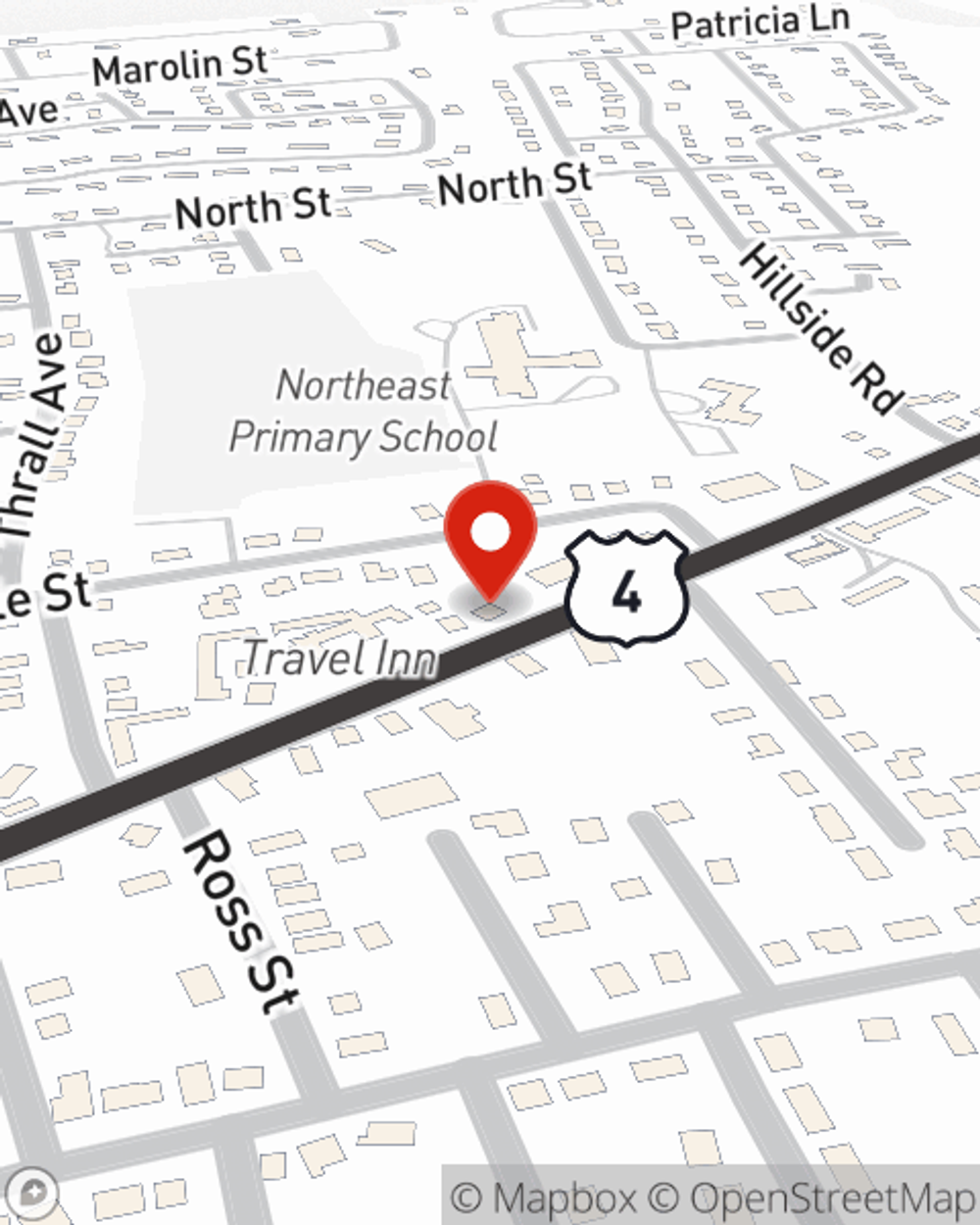

Contact State Farm Agent Ernest Soto today to learn more about how a State Farm policy can protect items in your home here in Rutland, VT.

Have More Questions About Renters Insurance?

Call Ernest at (802) 747-7283 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Ernest Soto

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.